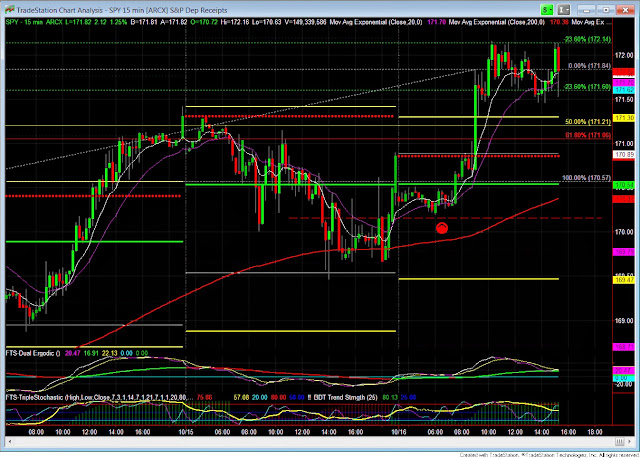

If we get some room to the down side we will be able to move our stop to break even tomorrow night. We will let that run for Mutual Fund Friday and hope we stay in. We do have two resistance points (support) you need to be aware of, 175.56 and the 171.02. The idea is to ride this short to the 171.02. When we hit the target, take the back test of the 171.02 for a long.

Teaching family and friends to trade their retirement accounts for FREE! * Following the SPY for market swing trading directions. *Green Long's (stocks and retirement accounts), *Red Shorts (out of stocks and retirement accounts. *Comments are updated at the close of market once a day.

Thursday, October 31, 2013

SPY is still in shorts. We did close below the PP for the day. We did test the long but it sold off. We have a fight over the trend. Move your stop to 177.07. Friday is Mutual Fund Friday so that tells me money will be coming into the market with market orders. We may have a pop on Friday. Keep an eye on the market so your stops don't get jumped. Check the ES in the morning for the warning signs.

Options traders: We are still in a put option long. Keep your stop at 3.91. At the end of day Friday we should be able to move our stop to breakeven or a small profit.

Wednesday, October 30, 2013

FOMC day, Markets did move, but really sloppy. We exited our second long on the SPY at 176.79 for a 9.29 profit. Our option contracts exit at 4.84 for a 323% gain on the second half. We reentered short on the SPY at 176.80 with our stop at 177.23. WARNING, tomorrow if we break the 176.97 it may take out our stop. This is a counter trend trade. Very risky. If the market closes below the PP (primary pivot) tomorrow we have a good chance to fall next week for a pull back for another long. If we rise tomorrow and back test the PP then you can reverse and take it long. Remember we are at highs and it may be sloppy. Manage your losers and let your winners run. Small losses and large gains. Check the ES in the morning to see if we have moved above the ES, PP. If we have, before the market opens, then take appropriate action.

Warning!! Close all you longs if we close below the PP! We came within 20 ticks of our target. Look for a back test of the PP and take it short, after the FOMC meeting at 2pm EST. PP at 176.86. It is FOMC day so expect volatility. After the last FOMC meeting we popped until the following day. Stick to the rules... If you do get into a short place your stops at highs.

Tuesday, October 29, 2013

Choppy grind up today on the SPY. Lock in more profits. Move stop to 175.97. We are with in 1 full point of our target. Keep a close eye on the market Wednesday and Thursday. Keep your stops tight because Fed will be talking tomorrow and the market may pop Wed and Thurs then tank Friday. It happened in the past after the Fed's talking.

Option move stop to 4.43! That is a 300% gain to date on the second half!!

Option move stop to 4.43! That is a 300% gain to date on the second half!!

Monday, October 28, 2013

Friday, October 25, 2013

Thursday, October 24, 2013

ES moved above its Primary Pivot overnight. Going to take a long in the SPY on the bounce between 174.75 and 174.56. Wait for confirmation with your indicators. If you get in put your stop at 173.87. Do not add to your options. Not enough room to move before we hit target. Trade half size to the new high. Or sit on the side until a larger pull back. Yellow light today. Careful for the day.

Target is 177.82

Target is 177.82

Wednesday, October 23, 2013

Was an interesting day on the SPY. We just went sideways all day. We did get our stop taken at 174.16. That gave us a 7.60 points on the SPY. Now for tonight we closed below the PP. This is a warning that the trend may change. The entry short will be at 174.95 with the stop at 175.40 tomorrow. Overnight if the ES pops above the All the Way Half Way Back (AWHWB) and keeps moving higher then tomorrow we will look for an other long. We will take the long at the PP back test when it hits tomorrow.

Now for your option players:

We entered on or around 1.50 and we took half off at 90%. We still have the second half in the trade. Move our stop to 3.50. Be careful with the over night. If the market drops your stop may get jumped and you will have to get out. If you are already out then the game plan is the same as above with options. Wait for a AWHBS with a stop above the 61.8.

Now for your option players:

We entered on or around 1.50 and we took half off at 90%. We still have the second half in the trade. Move our stop to 3.50. Be careful with the over night. If the market drops your stop may get jumped and you will have to get out. If you are already out then the game plan is the same as above with options. Wait for a AWHBS with a stop above the 61.8.

Tuesday, October 22, 2013

Monday, October 21, 2013

Friday, October 18, 2013

Wednesday, October 16, 2013

WARNING!!! SPY closed below the PP (Primary Pivot) Move your stop to 169.43 and watch the market tomorrow at open. Keep an eye on the ES overnight, if the ES drops then get out of the SPY in the morning. If the ES overnight goes up then keep your stop at 169.43. We locked in 1.86 points. Tomorrow is a pivotal day.

Keep an eye on your stop, the market may jump your stop if we drop below the stop in the morning.

Keep an eye on your stop, the market may jump your stop if we drop below the stop in the morning.

CFTC RULE 4.41 -

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE

AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL

TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE

UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS,

SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO

SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO

REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE

PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Subscribe to:

Comments (Atom)