Teaching family and friends to trade their retirement accounts for FREE! * Following the SPY for market swing trading directions. *Green Long's (stocks and retirement accounts), *Red Shorts (out of stocks and retirement accounts. *Comments are updated at the close of market once a day.

Friday, December 19, 2014

Yellow light

We had a gap up yesterday and I'm still waiting for the pull back to go long at the 202.34. Never got filled.

Thursday, December 18, 2014

Yellow Light until gap fills. Then Green Light.

Going long today in the SPY but I will wait until we fill the gap. I have Options Calls waiting at the bottom of the gap to be filled. The large traders want their fill and will most likely push it down to get filled. But this is a risk. I just may pop and not fill. So we wait and see.

Wednesday, December 17, 2014

Yellow Light

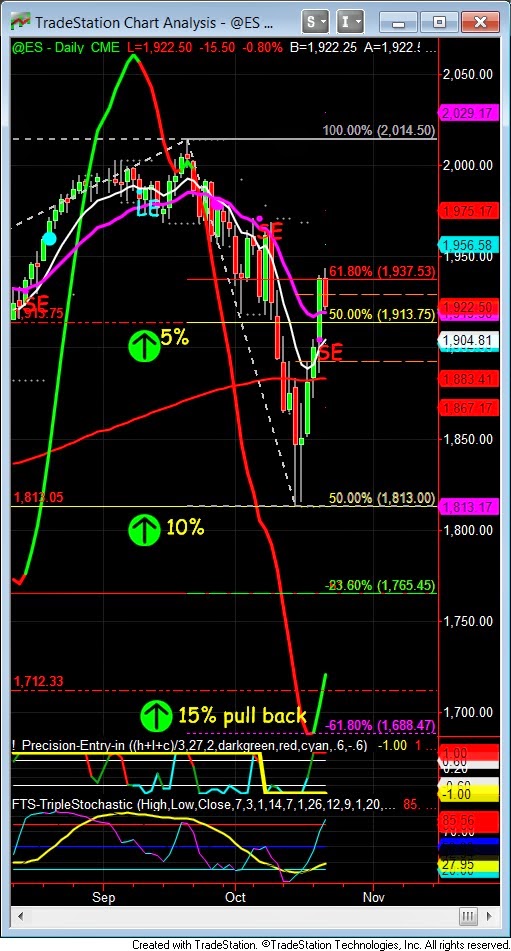

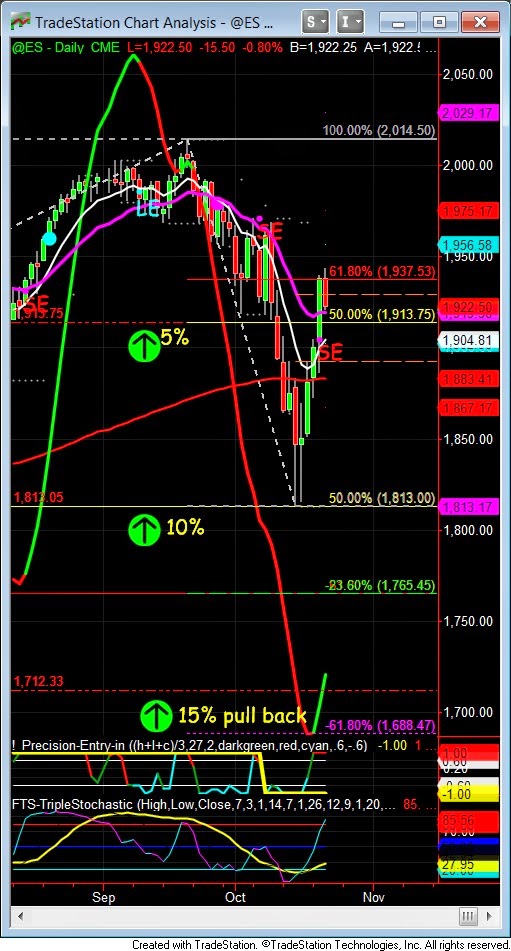

Did not make a higher high today but we are bouncing off the 5% pull back. I did get long SPY call options today. Not sure this is the bottom but giving it a shot. If we push up tomorrow and close above today's high then you can start buying selective stocks on Thursday.

Tuesday, December 16, 2014

Yellow light!

We hit the 5% pull back. Look for a bounce. When we get a higher high on the daily go long with stops at the low.

Sold my SPY Put option this morning.

Friday, December 12, 2014

Thursday, December 11, 2014

Red Light

Looks like the big player missed the half back short yesterday. Today we had a second chance to go short. The big player always what their entry to go short so they pushed the market up to enter short.

Red Light

We may get a bounce on the SPY. I think some of the large traders missed the Half Back Short and they may push the market up to get a fill at 205.72

Bonds Red Light

Bonds bounced off the Fib 50% ish and ran to the target at -23.6%. Trading Bonds short.

Short target for bonds is 142 20/32.

This will be a green light. But not yet.

Now, you are looking for this set up on the daily chart. Large wick at the bottom of the low, with an over sold indicators moving to the up side. When you get a higher high on a bar and it closes above the previous day, you can start going long in the market. Start small. We still will not have a confirmed up trend until it breaks a 61.8 fib from the high to the low of the pull back.

Wednesday, December 10, 2014

Red Light!

Expect a pull back to fill some gaps and possibly hit the 5% retracement. The market is looking for a pull back to buy stocks at a discount. How much is lower is unknown. History has the market going higher this time of the year until about the third week in January. So I don't expect this to last long. Get short the major indices as a hedge against your longs is you did not exit our longs.

Have a list of stocks ready to go long when the market turns up.

Red Light!!!!

Looks like we are going lower. We got our half back short today on the SPY. Sold all stock and have a standing order in short on the SPY put option. Not filled yet. Look to short the market.

Tuesday, December 9, 2014

Yellow light.

We had a gap fill today. But I think we may still go lower. But trade what you see not what you think. So look for a possible bounce.

Monday, December 8, 2014

Yellow Light.

This will be a deeper pull back. We have one Red bar and looking for 2 more to the down side. We will place a Fib from high to low and wait for the pull back then take shorts at the 50% retracement. If it breaks the 61.8 retracement we will continue our long. If the market moves down we will sell stock and look for shorts.

Wednesday, December 3, 2014

Tuesday, December 2, 2014

Yellow Light

Never got a third bar lower today. We did close within the previous days bar. So that is telling us we are still looking for a third bar lower tomorrow or a bounce higher. Still long but not strong. Again wait for the half back short before selling your long positions.

We did get a bounce today and it did break the 61.8 for the short. So we sit and wait until tomorrow's close. Still looking for the half back short.

Monday, December 1, 2014

Green Light until !!!

Market is slowing down. Still Green Light until we get 3 red bars down on the Daily. We have two for now. No going long in stock and options. Still holding what I have. If we get a 3rd bar down place a fib from highs to lows and look for the half back short at the 50 to 61.8%. Go short in the major indices with a stop 4 ticks above the 61.8. Looking for a pull back. When the half back short triggers remove your long stocks and options from the market. Do not take longs at this time until we break the half back short.

Green Light

Looking a little weak in the markets. We may get a small pull back to the 2042.80 for a new buy long. Let the winner run.

Monday, November 24, 2014

Green Light

I've noticed people selling off stock last week. More then normal. The market can still go up so heads up for a possible sell off in the next few weeks.

Friday, November 21, 2014

Green Light

We had a gap up with a sell off all day. Lot of people took profits today looking for the gap to fill. Everthing is over bought but that does not mean that market can not go up. Still Long and not as strong.

.http://screencast.com/t/i3U9OrCx

Thursday, November 20, 2014

Green Light

Still looking strong on the weekly. Ergo just turned green and moving up. Sto is at its highs so warning sign for a small retracement. OBV is still in an up trend.

Did get some bad news from China and Europe today. If we go down 3 bars lower on the daily, look for a Fib half back short and get some Puts in the SPY, SPX, QQQ, Dow and other markets. Place stop just above the 61.8.

Did get some bad news from China and Europe today. If we go down 3 bars lower on the daily, look for a Fib half back short and get some Puts in the SPY, SPX, QQQ, Dow and other markets. Place stop just above the 61.8.

Tuesday, November 18, 2014

Monday, November 17, 2014

Green Light

Consolidation for now. The OBV is still moving up and the Stochastic is in pull back mode. I believe markets will move higher. If we get a new high, up we go. If we move lower look for a half back short on a Fib.

Friday, November 14, 2014

Green Light

Green Light

Getting a little hesitation from the market. We had bad news from China. This may be a minor pull back. We have an engulfing bar on the ES. If it pulls back look for a half back short with a Fib to confirm a lower move. If the Fib breaks the 61.8 then we will go higher. If Fib does not break and goes lower I will buy PUT options on the SPY and the SPX. and exit my CALL options.

Wednesday, November 5, 2014

Green Light

Higher highs today. This move is weak but still going up. Buy quality stock only. History shows after the mid-term election the market goes up for the next 9 months 100% of the time, for the last 30 years.

Yellow Light

If we get a higher high the Doji has broken and you can start buying stock again. But only strong stocks. Not much volume in this move up.

Friday, October 24, 2014

Green Light

Well we squeaked out a higher high today. Looks like we are green to go long on Monday. I have 3 long is DATA, SPY and TJX all options. TJX is having some issues right now, but I will hold it for now. Next issue is the OBV need to break the trend line down for conformation higher. There is always something. If we do get a hesitation next week I will buy Puts in the SPY and maybe sell a call in the TJX to protect my trade. Have a great weekend everyone.

Thursday, October 23, 2014

Green Light

We finally closed above the 61.8 but its a Tombstone Doji. So proceed with caution. Volume is average. I sold my SPY put this morning for a small loss and bought a Call for the next few days with my finger on the sell button. You can buy selective stocks as well.

Wednesday, October 22, 2014

Yellow Light

We may get a pull back to the 50% with the FTS fast line at the top and looking for a pull back. It will take a few day to complete this move. I will buy a SPY option Call if it hits the 50% with a stop below the 61.8. I will be looking for conformation before I trade.

Yellow light!

We broke the 61.8 retracement but the market had no conviction with low volume. Need a higher high tomorrow for go long.

I did buy a PUT long in the SPY to protect my long stocks. Short at 1926.30. Will wait for the over night futures to determine and action tomorrow.

I did buy a PUT long in the SPY to protect my long stocks. Short at 1926.30. Will wait for the over night futures to determine and action tomorrow.

Subscribe to:

Comments (Atom)